Highlights of Budget 2016-17

Every year, on the last working of February, the Finance Minister of India announces the Union Budget Plan for the next financial year. The Budget for the financial year 2016-17 was announced on 29 February 2016. What are the highlights of the new budget 2016-17, and how will the changes in the union budget influence our lives in the coming financial year? Here are a few points explaining it:

Changes in taxes

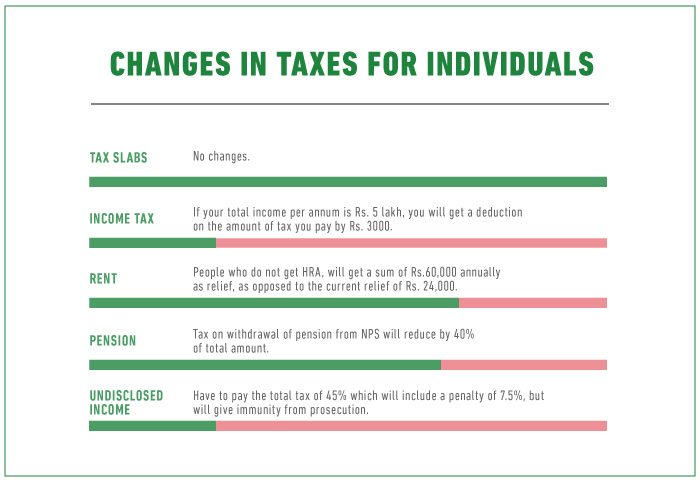

No Change in Tax Slabs: There is no change in the income tax slabs, existing slabs to continue.

Income tax: Under the new Budget plan, the deduction limit of the Income tax for people earning less than Rs. 5 lakh per annum has been increased to Rs. 5000, from the existing Rs. 2000. This means that if your total income per annum is Rs. 5 lakh, you will get a deduction on the amount of tax you pay by Rs. 3000.

Rent: The taxpayers who do not own a house and do not receive House Rent Allowance (HRA) from their employers, will get a sum of Rs.60,000 annually as relief, as opposed to the current relief of Rs. 24,000.

Pension: The National Pension System (NPS) is reducing the tax on withdrawals by 40% of the total amount accumulated, i.e. you will pay 40% less tax on your pension under the NPS. This will make the National Pension Scheme more competent against other pension products like Public Provident Fund & Employees’ Provident Fund, where the withdrawal is tax -free.

Undisclosed income: If you declare undisclosed income you, will have to pay the total tax of 45% which will comprise of 30% Income Tax, 7.5% surcharge and penalty of 7.5 of the undisclosed income. This will give you immunity from the prosecution.

Impact on start-ups

.jpg)

Profit tax deduction: Start-ups to get 100% deduction for their profits for the first 3 out of 5 years, it has to be set up during April, 2016 to March, 2019 but MAT will apply in such cases.

Funding: Funds for SC/ST & women Entrepreneurs: Stand-Up India scheme will allocate Rs.500 crore for the SC/ST & women entrepreneurs.

Impact on companies

80JJAA deduction for companies: Companies that are subject to statutory audit and are undertaking certain industrial projects, will get deductions in income tax.

Micro, Small and Medium Enterprises Turnover Limit: The tax deduction limit for MSMEs (Micro, Small and Medium Enterprises will be raised to 2 Crores, from the existing 1 Crore. This will be a huge relief for small enterprises.Individual Professionals too can avail of this scheme. Their profits will be deemed to be at 50% with gross receipts up to Rs.50 lakhs.

Increase in Surcharge for the rich: The upper class will have to pay more income tax due to increase in the surcharge rate from the existing 10% to 15% , this applies to the individuals whose earnings are more than Rs 1 crore.

Corporate Tax for Small and Medium Enterprises (SMEs): Corporate tax rate for the relatively small enterprises i.e companies with sales not exceeding Rs. 5 crores (in the financial year ending March 2015) is reduced to 29% plus surcharge & cess.

These are a few highlights from the Budget 2016-17. If you have any specific questions or suggestions, do write to us on Facebook and Twitter pages, or email us at jaagorein@gmail.com.

Source of Information: Rishabh Parakh (CA)

About the Expert:

The Hindu

Indian Express

Share this story on