The Highlights of Budget 2017

The Budget presentation was preponed so as to allow enough time for the different departments of the government to access their allocations and put them to work as soon as the new fiscal year starts. The Finance Minister Arun Jaitley presented the Union Budget 2017 on 1st of February.

Here are a few highlights of Budget 2017.

Personal Income Tax:

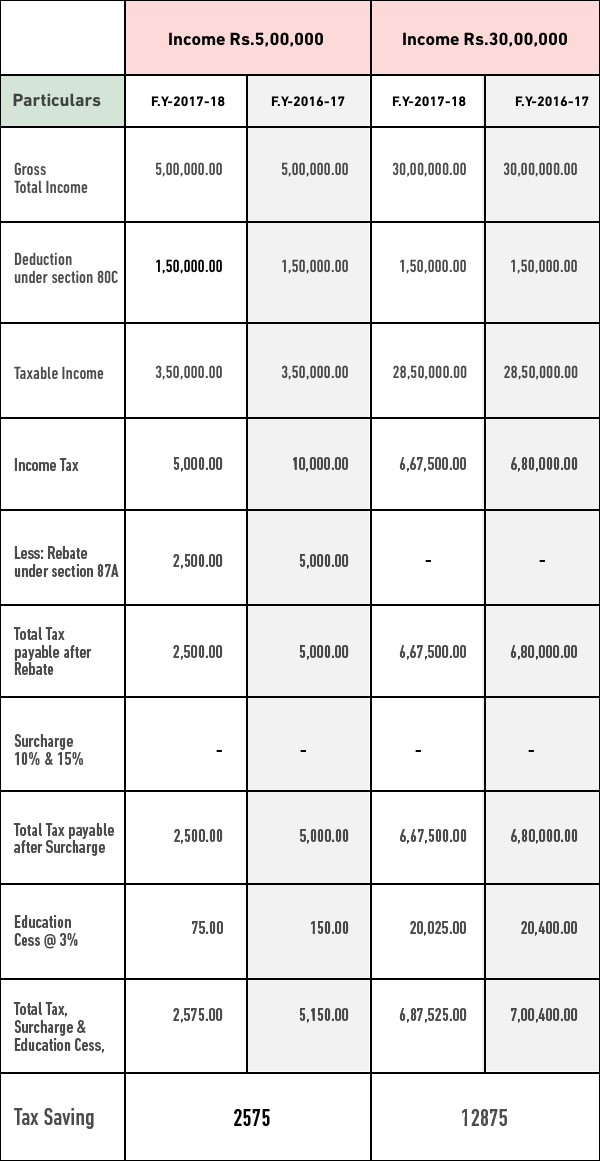

There is no change in the tax exemption limit under 80C but the government has reduced the tax rate to 5% for assessee whose income is between 2.5 lakhs to 5 lakhs and Zero tax liability for those earning up to rs. 3 lakh.

A taxpayer with taxable income of Rs. 5L will save a tax of Rs. 2575/-

A taxpayer with taxable income of Rs. 30L will save a tax of Rs. 12,875/-

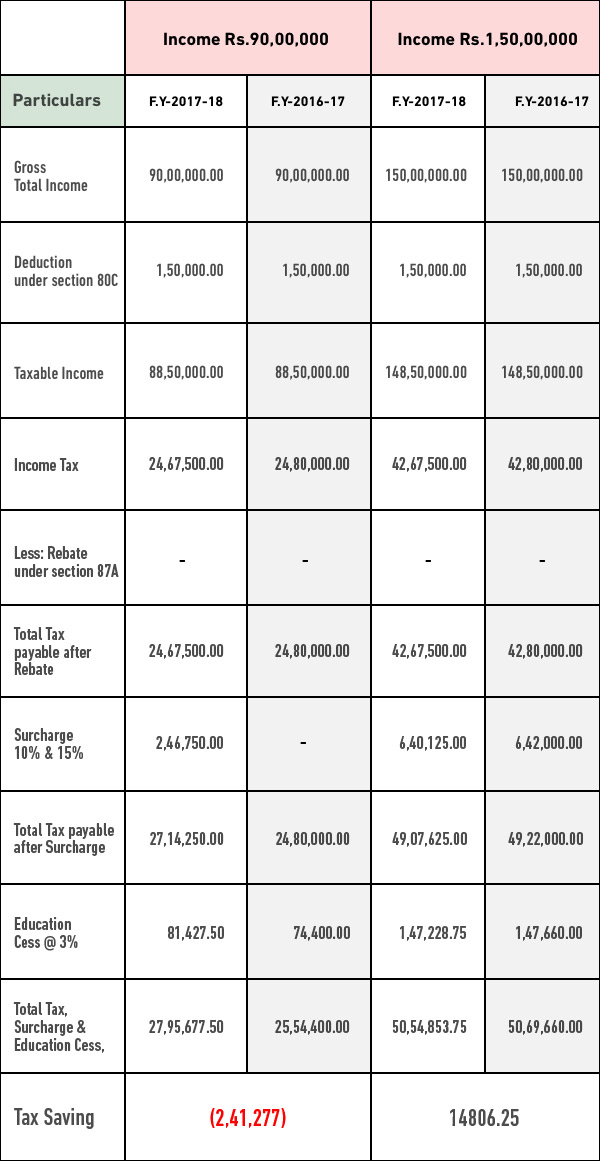

A taxpayer with taxable income of Rs. 90L will pay extra tax of Rs. 2,41,277/-

A taxpayer with taxable income of Rs. 1.5Cr will save a tax of Rs. 14,806/-

Let us see the changes in your income tax slabs based on the table (different income levels) and on the assumption that you have already exhausted your 80C limit.

Introduction of Surcharge: A surcharge of 10% will be levied on individual incomes above Rs 50 lakh and upto Rs 1 crore, and this will inflate the tax outgo for people falling under this income range, as seen in the table.

No Scrutiny for first time filers: No scrutiny will happen for the Assessee who will be filing return for the first time.

Change in Holding Period for Capital Gains on immovable properties: The period for eligibility of qualifying as a long-term capital gain on immovable property is reduced to 2 years (from 3 years) and the base year indexation is also shifted from 1.4.1981 to 1.4.2001.

Simplified ITR form: A new 1 page ITR form will be introduced for the taxpayers whose income is up to 5 lakhs but this does not apply for the person deriving income from business.

ITR Revision: Now revising your Income tax return will not be easy as the time period is reduced to 12 months from the completion of a financial year, the current time period is a two years’ window.

Limit on Cash transaction: Now cash transaction above Rs. 3 lac will not be allowed and this decision is based on the recommendation by the Special Investigation Team (SIT) on black money which was set up by the Supreme Court.

Extension of Tax Break for Start-ups: Profit-linked deductions which is available to the startups is increased to seven years from the existing five years.

Cap on NPS withdrawal: Now going forward, partial withdrawals from your NPS cannot exceed 25% of the contribution, as per the PFRDA (Pension fund regulatory and development authority) Act 2013. This will become effective from 1st April 2018.

TDS on Rent above Rs. 50,000/-: People staying on rent and paying a rent of more than Rs 50,000 per month will have to start deducting a TDS of 5%. This is to bring in line the recipients of large rental income so that they come forward and declare their full rental income in their tax return, this will effective from 01-06-2017.

These are just a few pointers from the Budget presented by the Finance Minister. For more details, visit the Union Budget website of the government of India, and share your views on the Budget on our Facebook and Twitter pages, or email us at jaagorein@gmail.com.

Disclaimer:

The views expressed here belong to the expert alone, and do not necessarily represent that of the brand.

About the Author:

Share this story on