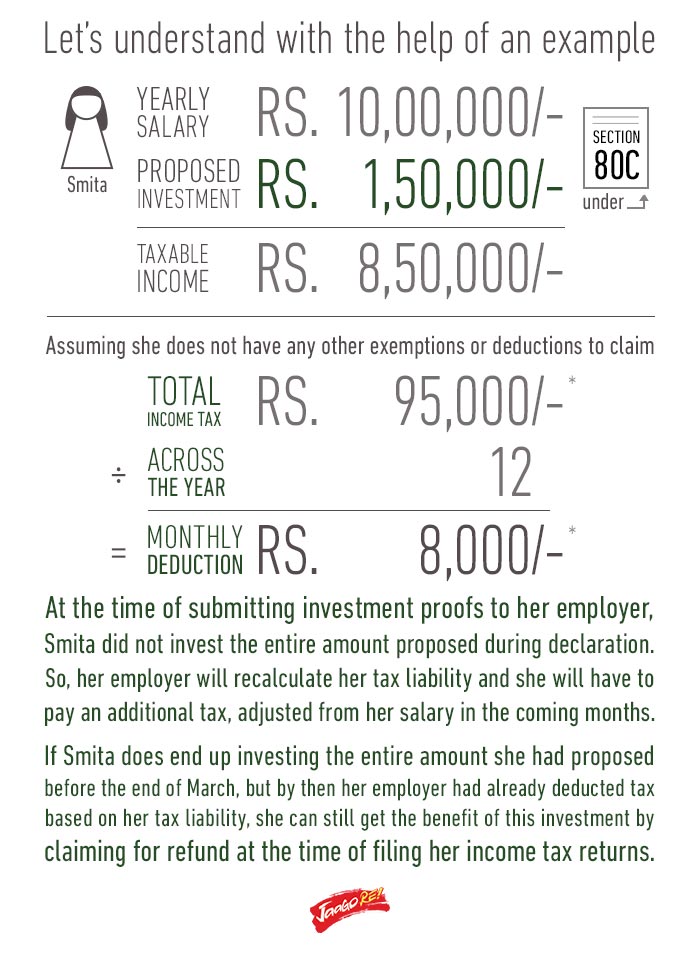

Declaring and submitting proofs for Investments

The end of financial year is approaching, and employed people must have received communication from their employers to submit their investment proofs for the year 2015-16. Let us understand this process and how you can save taxes with the help of investment declaration to your employer: -

What is Investment Declaration?

All employers deduct income tax from your salary on a monthly basis which goes to the government. The government allows tax saving on certain investments, like Life insurance premium/tuition fees/Home Loan Principal, NSCs, PF, PPF, Mutual Funds ELSS, Tax Savings FDs etcetera. Apart from that you are also entitled to claim benefit for LTA, HRA, interest on your home loans and Reimbursements of Medical expenses etcetera. These investments are not taxed by the government. Then, to know how much of your salary is taxable, the employer asks you to declare your investments.

How does it work?

At the start of every financial year, your employer asks you to submit a "declaration" of your proposed (existing) investments/options as mentioned above, so that your net taxable salary can be calculated and there by tax will be deducted and you get the net in hand every month.

Do you need to submit any proofs at the time of Declaration?

You are not required to submit proofs at the time of declaration. All you need to do is to plan your tax savings in advance in terms of how much is your obligatory/ongoing existing investments like PF, insurance premiums, tuition fees etcetera.

You can go ahead and submit a declaration that you "WILL" be investing in all the above mentioned items, this activity does not require you to submit actual proofs because it is just the start of the financial year, you only need to "Declare" that you will be investing in various 80C options, paying off rent to claim HRAs or claiming interest on your home loans.

What is the 'final Submission of actual proofs'?

During the months starting from December to January your employer will ask you to provide actual proofs for the investment declarations you had made earlier, so that they can verify and finalise your tax computation. So you need to submit all the copies/receipts/statements/proofs as against your declaration.

Do you need to invest in the same options as per your declaration?

Your investments need not be exactly the same as per your declaration. For example in your declaration, you might have mentioned that you will be investing in PPF or life insurance, but rather at the end you might have invested in a mutual funds ELSS or your home loan principal amount itself is more than Rs. 1,50,000/-. In that case, if you provide actual proofs of these investments which are different from your declaration, you will be eligible to claim the tax benefits and your employer will take these into account to calculate & finalise your tax liability.

What if you could not submit investment proofs?

If you could not submit investments proofs in time either because you have actually not invested the money as required or even though you had invested, you could not upload or submit the proofs to your employer, your employer will recalculate tax liability and will adjust the additional tax in the remaining months of January or February to March.

Do you lose the benefit in case you didn't submit the proofs to employer?

This is one of a biggest myth that if you don't submit proofs to your employer then you lose all the tax benefits; No, you don't. You can still claim the benefits of your investments by filing your tax returns and claiming a refund. But you should always make sure that you submit this in time to avoid going through claiming it via refund, which unnecessarily delays the entire process.

It is always better to plan your taxes in advance and invest on time, so that you can save more and avoid the hassle of claiming refund at a later stage.

Do you think this article is helpful? Would you like to know more about filing investment proofs? Write to us on our Facebook and Twitter pages, or email us at jaagorein@gmail.com.

More about the Expert:

Share this story on

5 points to understand the Compensatory Afforestation Fund Bill, 2015

The Lok Sabha passed the Compensatory Afforestation Fund Bill (2015) on 29th April, 2016 to establish funds for nationwide afforestation programmes. The Bill received support from people across different parties, and is expected to be instrumental in increasing the green cover in the country.

Here are a few points to help us understand the provisions under the Compensatory Afforestation Fund (CAF) Bill:

1. The Bill establishes the fund at a national level under a Public Account of India, and at state levels under the Public Account of the states. The Bill also establishes institutional mechanism at the national and state levels to ensure efficient use of the funds.

2. The national fund will receive 10% of the amount under this bill, and 90% of the funds will be given to the state funds. The main focus is to reduce the impact of diversion of forest lands, create productive assets, and also increase employment opportunities, especially in the rural sector.

3. The Bill also focuses on judicious and efficient use of unspent amounts with the Compensatory Afforestation Fund Management and Planning Authority (CAMPA), which is INR 38,000 crore, and additional INR 6000 crore per annum from the accrued interest on the unspent balance. The proposal does not involve any additional expenditure on the Centre.

4. The payments under the Bill will be allocated for compensatory afforestation, net present value of forests (NPV) which evaluates the loss of forest ecosystem, and other projects related to forests.

5. The proposed legislation will also look at providing safety, security and transparency in utilisation of the funds, which are currently kept in Nationalised Banks and are being managed by an ad-hoc body.

Read more about planting trees this summer

This Bill is a good step by the government towards ensuring environment protection and safeguarding the interests of communities dependent on forests for their survival. While the government is doing its bit, we too need to take up the cause of protecting and conserving our environment.

What do you think we as citizen can do to enhance green areas in our country? Share your views on our Facebook and Twitter pages.

Sources:

Press Information Bureau, Government of India

PRS Legislative Research

The Hindu

Share this story on

Freedom of Speech VS. Criminal Defamation

On 13th May 2016, the Supreme Court of India dismissed petitions that sought decriminalising defamation. The petitions claimed that criminal defamation went against the constitutional right of a person’s freedom of expression. In response to this, the Supreme Court pointed out that the criminal defamation law safeguarded an individual’s right to live with dignity and that protecting reputation of a person was equally important.

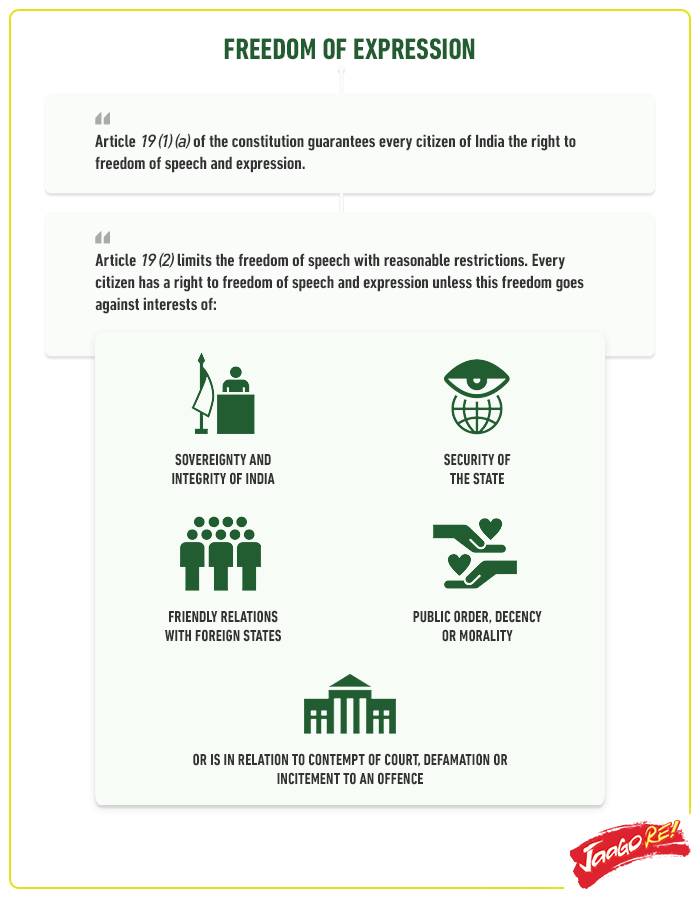

What are the major provisions under the freedom of expression and criminal defamation law? Let’s find out:

As you see, freedom of speech is not applicable in case of defamation.

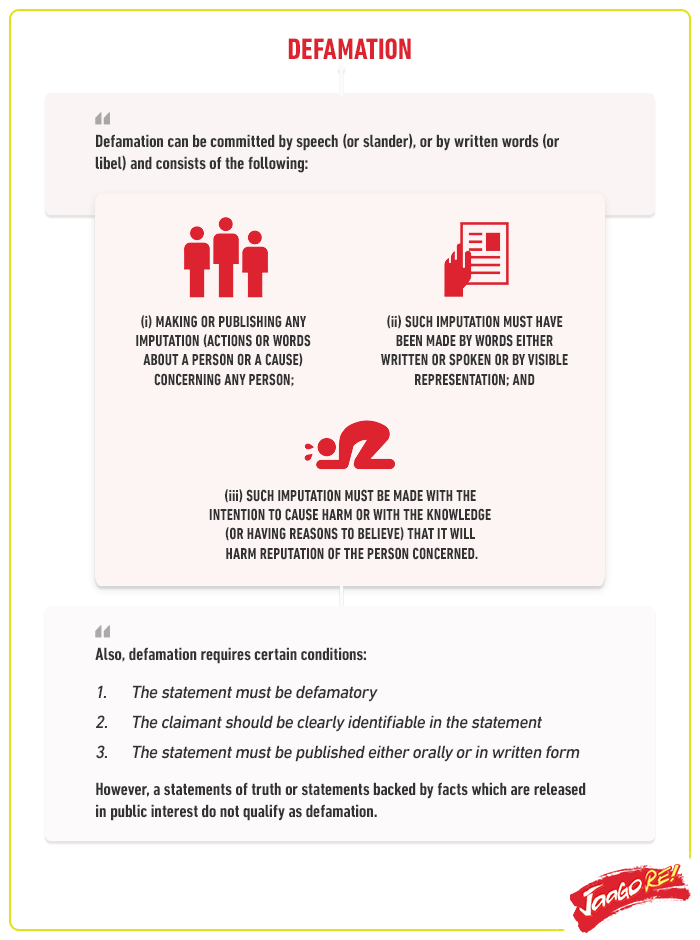

Section 499 of the Indian Penal Code defines what qualifies as criminal defamation. Criminal defamation refers to intentionally harming someone’s reputation. If the intent is not clear, then the lawsuit becomes a civil defamation. Here’s more information on defamation:

We have a right to express our opinions but it is also our duty to make sure that no other innocent person is harmed. While the Supreme Court has upheld the criminal defamation law, what are your thoughts on it? Do you think India needs a criminal defamation law? Write to us on our Facebook and Twitter pages.

Sources:

Ministry of Law and Justice

The Indian Express

Virtual Learning Environment, University of Delhi

Maharashtra Judicial Academy

Share this story on

What does the ‘Maintenance and Welfare of Parents and Senior Citizens Act’ say?

Are we a society that needs the law to tell us that we need to take care of our elderly?

On account of Parents’ Day, we had shared some statistics concerning the condition of the elderly in our country. Given the plight of senior citizens in our society, the Government of India passed an act called the Maintenance and Welfare of Parents and Senior Citizens Act in 2007. This Act exists to make sure that Indian senior citizens could live a life of dignity, which is often denied to them.

Here are a few points explaining the provisions in the Act:

Where is the Act applicable?

This Act extends to all of India, except the state of Jammu and Kashmir. It also applies to citizens of India residing outside the country.

The act talks about maintenance and welfare of the elderly and also their property rights.

What does the Act state?

It is a legal obligation for children/legal heirs to provide for the maintenance of a senior citizen

Children/heirs are obligated to take of care of their elderly parents in such a way that they can lead a normal life

Any person who is in possession or stands to inherit a senior citizen’s property and has sufficient means is liable to look after and provide for the senior citizen

If a senior citizen is not able to look after himself/herself, he/she can apply to a State Tribunal requesting for a monthly allowance from their children/heir

Punishment for not paying the monthly allowance could be a fine of Rupees 5000 or imprisonment of up to 3 months or both

What are the directions to the State Governments under the Act?

It permits the State Government to set up old age homes in every district

State Governments need to set up tribunals that can decide level of maintenance

State Governments are also required to fix the monthly allowance for senior citizens. The Bill states that the maximum allowance can be Rs. 10,000 per month

Though there are rules that state that children are obligated to look after their aging parents, we still hear a lot about the elderly being abandoned with nobody to look after them. Some of these senior citizens find solace in old-age homes run on charity and some are left to the mercy of others to provide them with care. While there is a law, don’t you think each of us needs to take up the responsibility of caring for our elderly?

Let us know your thoughts in the comments below, you can also reach out to us on our Facebook page, or tweet to us Facebook and Twitter pages. You can also send us an email at jaagorein@gmail.com

Share this story on

10 things you need to know about the Transgender Bill 2016

The Union Cabinet approved the Transgender Persons (Protection of Rights) Bill 2016 for introduction in Parliament, and this Bill is expected to bring social, educational and economic empowerment to the transgender community. To a community that has been ostracised and discriminated against for so long, this Bill could mean a chance to live a life of dignity and equality.

Here are a few points to help get a better understanding of the provisions in the Bill:

The Bill makes it illegal to force a transgender person to leave residence or village, remove their clothes and parade them naked, force them into begging or any kind of bonded labour. These acts will be punishable with up to two years of imprisonment, along with a fine and also asks for amendments in the law to cover cases of sexual assault on transgender persons.

The Bill also criminalises denying a transgender person access to any public place and causing them any physical or mental harm within and outside the home.

It guarantees OBC status to all transgenders not born as SC or ST, and entitles them to reservation under the respective categories.

The Bill identifies ‘Transgender’ as the third gender and gives a transgender person the freedom to identify as ‘man’, ‘woman’ or ‘transgender’, independent of surgery/hormones. They cannot be referred to as the ‘other’ gender or as ‘others’, but only as transgenders. A certificate of identity as a transgender needs to be issued by a state level authority and this certificate should be acceptable as gender identity for any official document like passport, aashar card, etc.

It also ensures that transgender persons or transgender children enjoy the right to equality, all human rights, right to life and dignity and personal liberty as guaranteed by the Constitution of India.

All government institution shall provide inclusive education and shall not discriminate against any transgender student and also provide transgender students with scholarship / entitlements, free-waiver, textbooks, hostel accommodations, other facilities and subsidized rates. Additionally, all educational institutions need to have an anti-discrimination cell to monitor discrimination against transgender students.

The government shall also set up rehabilitation and welfare programmes, information centres, sensitization programmes, etc. for transgender persons and provide necessary orientations to sensitize people in educational institutions and elsewhere.

The Bill instructs law the police to provide every assistance under the law to an aggrieved transgender person, and also to put the person in touch with the nearest organisation for rehabilitation of aggrieved transgender persons.

The Bill instructs the government to support and facilitate employment of transgender persons, especially for vocational training and self-employment, provide loans, and to ensure that there is no discrimination against transgender person at workplaces.

Under the provisions in this Bill, transgender persons shall also have equal rights and access to a cultural life, leisure and recreational activities.

The Transgender Persons (Protection of Rights) Bill aims at ensuring that transgender persons enjoys a life of dignity and equality as an Indian citizen, and guarantees a basic human right that had been denied to them for so long - right to identify as a member of our community and as equals. The Bill also instructs state mechanisms to include all possible provisions to ensure that no transgender person faces discrimination in India because of their gender identity.

Jaago Re believes that this is an iconic step by the government of India towards ensuring an equal, unbiased and awakened society. Now it remains up to us to take this vision from the government to fruition. Share your views on the Bill with us on our Facebook and Twitter pages, or email at jaagorein@gmail.com

Sources:

PRS India

DNA

The Indian Express

Share this story on

How India is empowering its youth

August 12th is celebrated as the International Youth Day, world over. On this day in 1985, the United Nations recognized the youth as an integral part of the society. The UN also acknowledged that the energies of the youth need to be harnessed effectively in a productive manner.

In India too, we have the ‘National Youth Policy’ that has been designed to effectively address the problems faced by our youth, and the related solutions. This policy expresses the vision the country has for our youth; it also identifies objectives and priority areas that are addressed and considered extremely important by the Government.

The five objectives of the National Youth Policy are as follows:

Objective 1

The first objective of this policy is to create a great workforce that can work for the betterment of the country and can make a sustainable contribution for the country’s development. The priority areas for this objective is education, entrepreneurship, employment and skill development.

Objective 2

To develop a strong and healthy generation that is equipped to take on future challenges. The main focus areas for the achievement of this objective are health and sports. Through this, the policy promises the promotion of a healthy sports culture among youth. It also ensures support and development for sports and related talent.

Objective 3

Promotion of community service is also another important objective of the policy - it focuses primarily on community engagement, through programs that gives the youth opportunities to engage and contribute to the grassroot development efforts in their local communities. Under this objective, promotion of social entrepreneurship is also seen as a way to involve in the youth in building the society.

Objective 4

Civic engagement in all stages of governance is another objective that is taken up seriously under this policy. To achieve this objective, the policy measures and monitors the effectiveness of youth development schemes. It also plans to create a platform for the youth to engage with governance at multiple levels.

Objective 5

The last objective of this policy is to support youth at risk and create equal opportunity for all disadvantaged and marginalised youth. Social justice is the most important area of focus under this objective. For this objective, leveraging youth to eliminate unjust social practices is being seen as the biggest area of focus. The policy also plans to strengthen access to justice at all levels.

With policies like these, will the youth be ably empowered to contribute to the society in a meaningful way? Do you think that the policy needs to focus on other areas? Which of these policies is most helpful to the youth according to you?

Share your thoughts in the comments section below; you can also reach out to us on our Facebook and Twitter pages, or email at jaagorein@gmail.com

Source: Ministry of Youth Affairs and Sports

Share this story on

Seven things you need to know about the RTI Act

In a revolutionary move, the Central Information Commission (CIC) announced citizens who file appeal/cases filed under the RTI (Right to Information) Act will now receive real time updates about the status of their cases. The updates will be delivered via emails and SMSs. While this is a great move, not many people have enough information about the provisions under the RTI Act.

What is the RTI Act?

The RTI Act was introduced with the sole objective of empowering people, containing corruption, and bringing transparency and accountability in the working of the Government. The Right To Information Act mandates that timely response be given to any citizen who asks for it. This was an initiative taken by the Ministry of Personnel, Public Grievances and Pensions to ensure a portal for citizens who searched and needed quick information.

Here are a few things you need to know about the Act and filing an RTI appeal.

Every public authority is obligated to maintain computerised versions of all records in such a way that it can be accessed over a network anywhere in the country and issued to the person who has requested for information.

Every public authority should provide essential information to the public through various channels of information (including internet) at frequent intervals so that the use of the RTI Act to obtain information can be kept to a bare minimum.

Any person who desires to obtain information shall submit a written or electronic request in English or Hindi or in the official language of the area to the Central Public Information Officer or his/her counterpart at the state level.

No applicant will be required to give any reason for application for request or to provide any personal information except for contact details where it is necessary for the authorities to contact the applicant.

In case an appeal is rejected, the Central Public Information Officer or his/her equivalent will communicate the reason for rejection, period within which an appeal against the rejection can be made and particulars of the appellant authority.

Under normal circumstances, the information requested for will be provided in the form sought for - if a citizen asks for some information in the form of an email attachment, it will be provided unless it causes damage to the original document itself.

The authority will be under no obligation to provide such information that might hurt the sovereignty and integrity of India, information that has been forbidden to share by any court of law, information received under confidence by a foreign Government and cabinet papers.

With the information provided above, any citizen will be able to file a case/appeal under the RTI Act. Citizens will need to make use of such provisions more often to turn India into a participatory democracy. A citizen’s duty does not end with voting and the RTI Act is a great tool for citizens to come together and be more involved. The government is taking steps to make sure that citizens are not denied the right to information by making the application and follow up process easy. Are these steps compelling enough to make more citizens aware about these facilities provided by the Government? Share your views and questions with us on our Facebook and Twitter pages, or email at jaagorein@gmail.com

Share this story on

How does the Trafficking of Persons Bill propose to #FightHumanTrafficking?

India is a part of the most active region when it comes to human trafficking. According to NCRB data, India saw a sharp increase in 2014, and women and children make up around 76% of the total human trafficking cases. Statistics related to Human Trafficking in India show that the situation is quite grave.

To address this menace, a bill was proposed in 2016, and it is still pending in the parliament. As we observe the National Human Trafficking Awareness Day, here’s a brief overview of a few proposals made in the Trafficking of Persons (Prevention, Protection and Rehabilitation) Bill 2016:

Every district shall have a District Anti-Trafficking Committee which will be responsible for prevention, rescue, protection, medical care, psychological assistance, skill development and need-based rehabilitation of victims.

The Central Government shall set up a committee to oversee the implementation of the Act, and also constitute a Special Agency for investigation of offences under the Act.

Protection Homes shall be set up for the victims of human trafficking where they will be provided with all necessary care and aid. Victims will also be provided with long-term institutional support for their rehabilitation.

Schemes and Programmes will be implemented to facilitate social integration of victims into the mainstream society, especially for women rescued from prostitution or any other form of sexual exploitation.

Any form of disclosure of identity of victims or witnesses, or disclosure of details from an investigation or judicial procedure which can lead to identification of victims or witnesses shall be a punishable offence, with up to six months of imprisonment and/or a fine up to one lakh rupees.

Use of narcotics, psychotropic or alcoholic substances for trafficking is punishable with 7 – 10 years of imprisonment and/or a fine not less than one lakh rupees. Administering chemical substances or hormones to a trafficked woman or a girl or a child for earlier sexual maturity and exploitation shall be punishable with 7 – 10 years of imprisonment and/or a fine not less than one lakh rupees.

To provide a speedy trial, the State Governments, in consultation with the Chief Justice of the High Court specify a special court in each district. The State Government shall also designate a Police Officer of the rank of Gazetted Officer to be an investigating officer for offences under this Act.

A person prosecuted under the Act shall be considered guilty, unless it is proven otherwise by the judicial procedure. (the entire draft of the Bill is available at the Ministry of Women and Child Development Website)

While the Bill addresses many concerns w.r.t fighting human trafficking legally, there are many ways in which the society can help make such Acts and laws more effective. Knowing our laws and being prepared to take steps against trafficking is crucial in this aspect.

What are your views on the provisions under the Bill, and what do you think are the most effective ways in which we as citizens can fight Human Trafficking? Share your views with us on our Facebook and Twitter pages, or write to us at jaagorein@gmail.com.

Sources:

Ministry of Women and Child Development

Trafficking of Persons (Prevention, Protection and Rehabilitation) Bill 2016

Indiaspend

Share this story on

The Impact of GST (Goods and Services Tax) in India

After a lot of deliberation, our GST council has finalised the rates for all the goods and major service categories under various tax slabs, and the GST is expected to fill the loopholes in the current system and boost the Indian economy. This is being done by unifying the indirect taxes for all states throughout India.

The tax rate under GST are set at 0%, 5%, 12%, 18% and 28% for various goods and services, and almost 50% of goods & services comes under 18% tax rate. But how is our life going to change post GST? Let’s see how GST on some day-to-day good and services will have an impact on an end user’s pocket.

Footwear & Apparels/Garments:

Footwear costing more than INR 500 will have a GST rate of 18% from an earlier rate of 14.41 rate but rates for the footwear below INR 500 has been reduced to 5%. So, you need to shell out more for buying a footwear above INR 500/-. And with respect to the ready-made garments, the rates have been reduced to 12% from an existing 18.16% which will make them cheaper.

Cab and Taxi rides:

Now, taking an Ola or an Uber will be cheaper because the tax rate has come down to 5% from an earlier 6% for a cab booking made online.

Airline tickets:

Under the GST, tax rate for economy class for flight tickets is set at 5% but the tax for business class tickets will have a higher tax rate of 12%.

Train Fare:

There will not be much of an impact. The effective tax rate has increased from 4.5% to 5% in GST. But, passengers who travels for business trips can claim Input Tax Credit on their rail ticket which can help them to reduce expenses. People travelling by local trains or in the sleeper class will not be affected, but first-class & AC travellers will have to pay more.

Movie Tickets:

Movies tickets costing below INR 100 will be charged a GST rate of 18% but prices above INR 100 will have a higher tax rate of 28%.

Life Insurance Premium:

The Premium Amounts on policies will rise, with an immediate impact can be seen on your term and endowment policy premiums as the rates have been increased under GST across life, health and general insurance.

Mutual funds Returns:

GST impact on your returns from mutual funds investments will largely be marginal as the GST will be charged on the TER i.e. Total Expense Ratio of a mutual fund. The TER is commonly called as expense ratio of a mutual fund company, and the same is set to go up by 3%. The return what you get as an investor will be reduced to that extent unless the respective mutual fund company i.e. AMC absorbs it but that anyhow will be a marginal difference.

Jewellery:

The gold investment will become slightly expensive because there will be 3% GST on gold & 5% on the making charges. The earlier tax rate on gold was around 2% in most of the states and the GST is increased from the existing rate to around 2% to 3%.

Buying a Property:

Under construction properties will be cheaper than read-to-move-in properties. The GST rate for an under-construction property is 18% but the effective rate on this kind of property will be around 12% due to input tax credits the builder will avail of.

Education & Medical Facilities:

Education and Medical sectors have been kept outside the GST ambit and both the primary education & healthcare is exempt from GST. It means a consumer will not pay any tax for the money you spent on these services. But due to increase in the rate of taxes for certain goods & services as procured by these organisations, they may pass on the additional tax burden to the consumers.

Hotel Stay:

For your hotel stay, If your room tariff is less than Rs 1,000, then there will be no GST, but anything above Rs 5,000 will attract 28% tax.

Buying a Car:

Most of the cars in the Indian market will become slightly cheaper, except for the hybrid cars because the GST rate will be 28% tax on all the vehicles irrespective of their make, engine capacity or model. However, over and above this 28%, an additional cess will be levied which can be either 1%, 3% or 15 %, depending on the particular car segment.

Mobile Bills:

People will have to pay more on mobile phone bills as GST on telecom services is now 18%, as opposed to the earlier tax rate of 15%. However, telecom companies may absorb this 3% rise due to fierce competition.

Restaurant Bills/EATING OUT:

Your restaurant bill would depend on whether you dined at an AC or Non-AC establishments which do not serve alcohol. Now dining at five-star hotels will be charged at 18% GST rate and the Non-AC restaurants will be charged 12% and a 5% GST will be charged from small hotels, dhabas and restaurants who do not cross an annual turnover of INR 50 Lakh.

IPL & other related events:

Events like IPL i.e. sporting events will have a 28% GST rate which is higher than the earlier 20%.rates. This will increase the price of your tickets. And the GST rate for other events like theatre, circus or Indian classical music shows or a folk dance performance or a drama show will be at 18% GST rate, this is lesser than the earlier tax rate.

DTH and cable services:

The money you pay towards your DTH (Direct-To-Home) connections or to your cable operator will reduce a bit as the rate is fixed at 18%, which is lower than the earlier taxes which were comprising of entertainment tax in the range of 10% to 30%, apart from the service tax of 15%.

Amusements Parks:

The ticket price for amusement parks and theme parks will increase as the earlier service tax of 15% will become 28% under the GST.

Here’s is a list of some items which are completely exempt from the GST regime:

*The unprocessed cereals, rice & wheat etc.

*The unprocessed milk, vegetables (fresh), fish, meat, etc.

*Unbranded Atta, Besan or Maida.

*Kid’s colouring book/drawing books.

*Sindoor/Bindis, bangles, etc.

These are just a few ways in which the GST will impact daily life. How has your experience with GST been so far? Share your views with us on Facebook and Twitter pages, or email at jaagorein@gmail.com

Join the Tata Tea movement to pre-act against two of the most pressing issues in our society today - lack of women safety, and lack of a culture of sports in India. Petition today to build a safer society for women, by demanding compulsory gender sensitisation in schools, and to build a culture of sports in India by making Sports a compulsory subject in schools.

More about the Experts:

Share this story on