Salaried Employees to submit proof for LTA, HRA claims

The CBDT (Central Board of Direct Taxes) has introduced a new form (Form 12 BB) for claiming tax deduction towards LTA, LTC, HRA & interest paid for home loans. The new form mandates people to furnish proof of travel while claiming LTA, LTC, and details of landlord in case of HRA claims. Let us understand this in detail:-

Why this Rule?

The main reason behind introducing this rule is to plug the loopholes under tax laws by tightening the entire procedure for claiming these tax exemptions. This becomes more important because there was no standard or prescribed format until now for filing these declarations. And in the Budget 2015, the Finance Act had already introduced Section 192(2D) of the Income Tax Act mandating employers to collect all necessary evidences, but the rules and form were yet to be prescribed. The same has been done now.

What is this form about?

The declaration needs to be filed for claiming deductions in a prescribed form i.e. Form 12 BB as set up under rule 26C.

What is the obligation on the Employer?

Earlier the employers were not under any statutory obligations for collecting bills or other proofs in order to prove the fact that their employees have actually utilized the money they are claiming towards these claims.

But, the current amendment with the introduction of this rule will now make all the employers obligated to collect all the relevant information in the prescribed format apart from collecting the proof of evidence, before they can allow the respective benefits under various tax benefits to the employees.

Details needed to furnish LTA, LTC and HRA claims

The circular as issued by the government has not specified the documents required to be submitted for claiming deductions but the existing documents that employees used to provide should hold good. Following are the documents which are required to claim these benefits:-

HRA:

As per the notification issued by the government, a person claiming HRA (Housing Rent Allowance) for over Rs. 1 lakh needs to furnish name, address and PAN i.e. Permanent Account Number of the landlord, apart from giving the rent receipts. With this the government can start tracking the fraudulent claims and can also verify whether the rent received by the landlord has been duly disclosed in their tax-return.

LTA/LTC:

To claim LTA (Leave Travel Allowance) or LTC (Leave Travel Concession), people need to provide the evidence of expenditure, and submit boarding pass and tickets for claiming LTA or LTC.

Housing Loan:

To claim deduction on the interest on a housing loan, people need to provide PAN of the lender and their name and address.

Deductions u/s Chapter VI-A

People need to submit relevant proof for claiming deductions under chapters VIA(A) and VI-A that cover Sections 80C, 80CCC, 80CCD, 80E, 80G, 80TTA. Sections 80CCC, 80CCD and section 80C allow a deduction of Rs. 1.5 lakhs on specified investments.

What will be the impact of this new Rule?

The new rule and the forms will make it really easy for both the taxpayer and the employer because it brings standardization which will help employees and employers both. Moreover from the government's point of view, the new format will ensure collection and maintenance of information, and will assist them in streamlining their assessment process and curb the malpractice of fake claims.

When will this rule come into effect?

The rules will be applicable from June 1, 2016.

More about the Expert:

Share this story on

What is the Krishi Kalyan Cess?

The government has recently introduced the Krishi Kalyan Cess to fund programmes for the welfare of farmers. On June 1, 2015 Service Tax rates were hiked from 12.36% to 14%. The Swachha Bharat Cess was also introduced at the rate of 0.5% from 15th November last year. With the introduction of Krishi Kalyan Cess, the total Service Tax to be paid will be 15%.

Let us understand more about Cess in general, and about the Krishi Kalyan Cess.

What is a Cess?

A cess is a tax that is levied by any government for raising funds to achieve specific purposes. For example, the Education Cess and the Secondary and Higher Education Cess is meant to collect funds for primary and higher and secondary education.

As per the Article 270 of our Constitution, Cess is imposed by the Parliament for earmarked purposes and the same is not shared with state governments. If the collected money is not spent, then it has to be carried forward to the next year.

Read more about the Goods and Services Tax.

What is the Krishi Kalyan Cess?

KKC is a cess is a Service Tax which will be levied and collected under the provision of Chapter VI of the Finance Act, 2015 on all the Taxable Services. The cess will be charged at the rate of 0.5% of the value of the Taxable Service.

What is the reason behind introducing the KKC?

As per the government, the objective of introducing this cess is to collect funds for improving the life of farmers and enhance and finance the agricultural facilities.

When is this new Cess going to be applicable?

The krishi kalyan cess has come in to effect from June 1st and a person availing any services on or after 1st June’ 2016, or making any payment towards services post 1st June’ 2016 has to make additional 0.5% payment towards Krishi Kalyan Cess.

How will it impact your life?

It will increase your expense on services at restaurants, movie theatres, shopping, visits to a parlour, air travel, insurance premiums, cable/DTH services, healthcare and all the other services.

The reason behind the KKC could be the government’s move to ensure that we absorb taxes in smaller doses i.e. installments as compared to a sudden rise.

The proceeds from the cess to farmers’ benefit could be beneficial in the long run. The Krishi Kalyan Cess can create a positive effect but only after making sure that the benefit reaches to the farmers.

More about the Experts:

Share this story on

Filing Income Tax returns - What you should know

Most taxpayers pay their taxes well before the end of the financial year i.e. 31st March. For salaried employees, it gets deducted through TDS and gets paid in regular instalments round the year. But when it comes to filing for Income Tax returns, many taxpayers tend to miss the deadline of 31st July. As per the I-T Act, a tax return may be furnished any time before the expiry of two years from the end of the financial year in which the income was earned.

Let’s understand what it means to file IT returns, and what happens in case you don’t file your returns before 31st July 2016.

What does filing tax returns mean?

A 'return of income' or tax filing is the process where a person reports or declares to the government, the details of their income and the taxes paid by them.

It is like the 'No Objection Certificate' you have to get from the college library, before you leave college even if you never visited the library. It is to establish the fact that don't have any outstanding obligation, or if there are any dues, they have been cleared.

What are the benefits of filling income tax returns (ITR)?

Filing IT returns is not a choice. It is a legal obligation which should be fulfilled by everyone who falls under the prescribed category. However, if you still needs more reasons to file your returns, here are a few:

To avail home or personal loans.

For visa and immigration processing.

It is an income proof or a net worth certificate.

For claiming excess tax paid via refund.

Applying for a higher insurance cover.

My tax is already deducted at source by my employer and paid to the government, then why do I need to file income tax return?

Although tax has been deducted and there is no further liability to pay tax, you have to compulsorily file your income tax return if your income exceeds the basic exemption limit.

I have not submitted my investment details like life insurance premium, to my employer and excess tax has been deducted from my salary. Can I declare my investments and claim the benefit?

Yes, you can claim a refund while filing income tax returns.

What are the different sources of income?

Before you start your tax filing, you need to first determine the sources of your total income. Does your income comprise of only salary and interest on savings bank account or you also earn rental income, capital gains, or income from any other source?

Let’s see different heads and “Sources of Income” as per Income Tax Act as follows:-

Salary

Rental income from house property

Profit & gains from business or profession

Capital gains on sale of shares or mutual funds or capital assets

Other sources like bank interests, etc.

You will need to add your income earned under each “Head” and then compute your taxes. If you have a minor child, don't forget to add the income received by him/ her. This will include income due to interest on fixed deposits in the name of your minor kid. For them, you're not expected to file separate returns; they can be clubbed with the parents' income.

What are the documents required before filing income tax return?

Form No.16: Issued by your employer summarizing your income from salary and tax deducted at source.

Form no 16A: Issued by all payers who have deducted tax while making payment to you during the year. For example, banks where you have fixed deposits.

Property details: If you have bought any property or put up existing property on rent, then the details for the rent received and receipts of municipal taxes paid during the year, will be needed. If you've bought property by taking a loan, then you'll need to submit copies of loan certificates for the interest and principal.

Contract Notes: For sale and purchase of shares during the year for calculating capital gains.

Tax challans: You'll need to submit the details of the tax payments made by you, if you've paid any advance tax or self-assessment payments.

Bank account statements: You will need bank account statements of all your operating accounts during the year for arriving at interest income earned during the year.

Others: Any other documents for a financial transaction involving tax implications for computing your taxes.

Note: You don’t need to submit any of these copies to the I-T department during the process of filing income tax returns, and even originals are also not required to be given to your CA, if you are taking professional help. These documents are only required to help you prepare your tax computation and you should keep these copies handy, in case the I-T department asks you to furnish them.

What will happen if you don't file your tax returns by 31st July?

Interest Penalty: If you have some outstanding tax liability arising out of income from other sources or due to change in jobs as seen in my previous article and tax is still due even after deducting advance tax and TDS. In this scenario, interest penalty will be applicable @1% per month u/s 234A and part thereof up to the date of filing of the return apart from the other interest amounts as applicable u/s 234B & 234C.

Late/belated return cannot be revised: A return is called a Belated Return if the same is filed after the due date. You cannot revise a belated return at a later stage. And a belated return can be filed within a period of one year from the end of the relevant assessment year or completion of assessment whichever is first.

Carry forward losses: Filing your return beyond a deadline will not allow you to carry forward your losses like long-term or short-term capital losses on Shares. But when it comes to carry forward of losses on house property, the same can be carried forward even if the Income Tax return is filed after 31st July.

Delay in getting Tax Refund: Your claim for refund will get delayed and you may also tend to lose interest on refund u/s 244A as delay in filing will be attributable to you.

Section 271F Penalty: If you do not file your return within a period of one year from the end of relevant assessment year then Assessing officer may levy a discretionary penalty of Rs 5000. For example, there will be no penalty if the return of income for the previous year ended 31st March, 2013 is filed by 31st March, 2014. If it is filed after that, the officer may levy this penalty which is mostly not exercised.

For any clarification on filing Income Tax returns, contact the accounts department of your organisation, or write to us on our Facebook and Twitter pages, or email us at jaagorein@gmail.com.You can also read more articles on Budget and Finance HERE

More about the Experts:

Share this story on

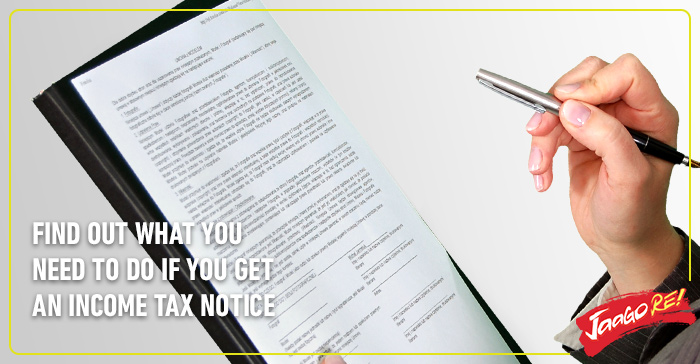

Why you could receive an Income Tax Notice

Any communication from the Income Tax department, be it a simple enquiry or an intimation or receiving a notice, can be unnerving. Recently, the Income Tax department issued 7 lakh letters to those who have entered into high value transactions without quoting PAN – transactions like cash deposits, sale/purchase of immovable property valued at INR 30 Lakh or more, etc.

In this three-part article, we will take you through the circumstances under which an income tax notice can be served to you, how to respond in case you get a notice and how to avoid getting an income tax notice.

Read further to know the circumstances under which you could receive an income tax notice.

#1 – Not filed your IT returns

Any individual earning more than Basic Exemption Limit i.e. Rs. 2,50,000/- p.a. needs to file tax returns compulsorily, even if the tax is already deducted (TDS) and paid . If you have not filed your returns for past few years, then you could get notice/intimation from the IT department.

#2 - Interests from FDs or Savings A/C

Generally banks deduct 10% TDS on the deposits interest by default, but additional tax maybe applicable depending on your income tax bracket. The myth is that one does not need to pay any tax if TDS is cut by the bank. If this has not been, you could get a notice,

#3 - Sudden drop in Income

If there is a significant reduction in your income from last year, it may cause suspicion and might invite an IT Scrutiny. This is more applicable in case of businesses and traders, because their income is highly volatile. However, in case of salaried people, this does not pose a problem.

#4 - Claiming Higher refund amount or Relief under various sections of IT Act

If you have filed your returns claiming a high refund in a particular year, there are chances that you might get a scrutiny. This is because you could be asking for a higher amount to be refunded to you. Dues to this, the tax department may want to have a look at your documents and might question things. Similarly, claiming a relief also attracts scrutiny these days.

#5 – Mismatch in TDS credit

Check & reconcile your form 26AS all taxes paid on your account. Ideally, the TDS amount claimed in your income tax return and the TDS actually updated in your form 26AS should be the same. That makes it important to check your 26AS and make sure it has been updated accurately.

#6 – Non Declaration of Exempted Income

There are various incomes on which you don’t have to pay income tax, but must be still mentioned in the income tax return. Things like your long term capital gains tax from equity/dividends received on equity shares of Indian companies/Saving bank account interest up to INR 10000/PPF interest. These are some of the things which are exempted from tax, but still need to be declared.

#7 – Taking double tax benefits due to change in Job

Sometimes, salaried employees who have changed jobs during the previous year get multiple Form 16 & fail to declare income from all the employers & calculate and pay the due taxes, if any. It may give rise to certain deductions & benefits given twice.

#8 – High Value Transactions

If you have executed high value transactions either for investments or spending then chances of you getting the notice from IT Department are very high. For instance, credit card usage of more than INR. 2 Lakhs p.a. / investing in FDs / depositing more than INR. 10 Lakhs in your bank account, etc. All these transactions need to be reported to the IT department under Annual information Returns filed by respective companies and may attract an enquiry ranging from simple to exhaustive by IT department.

Following the above steps will make sure you stay away from an IT notice. Are there other IT habits that you can think of to steer clear of an income tax notice? Share your views and questions with us on our Facebook and Twitter pages, or email at jaagorein@gmail.com

More about the Experts:

Share this story on

How to avoid receiving an Income Tax notice

In our previous article, we told you the circumstances under which you could get an IT notice. Read further as we tell you how to make sure you do not get an IT notice.

The Income Tax department becoming net savvy and going online has made it easy it for them to identify discrepancies in papers and to keep a close eye on almost every financial transaction that takes place. Sometimes, even honest taxpayers have received notices and have come under the scrutiny causing them to run around to prove their honesty. This makes it very critical for everyone to maintain their papers & documentary evidences to safeguard their own interests.

Here are the steps you need to take to minimize your chances of receiving a notice –

Always file your returns on time and correctly – This is the basic precaution you need to take to ensure 100% compliance with the law. Make sure you are filing returns correctly and details given by you while filing Returns match with the details available with the IT department.

Submit ITR V to Centralized Processing Centre (CPC) Bangalore: Your filing of taxes will be considered complete only when your ITR V reaches CPC. Just uploading returns online is not enough; make sure you get confirmation of its receipt from CPC. Do follow the Dos & Don’ts of sending ITR-V to CPC.

Check your form 26AS (Tax Credit Statement): “26AS” gives details of the “TDS” deposited on your behalf. Check all TDS payments duly credited to you and get it rectified if need be. It can be viewed through NSDL or IT department’s site and even through your bank’s online portal.

Mismatch in Income & Expenses/investments: If your income was INR. 10 lakhs and you invested INR. 25 lakhs, you will need to justify the source of these funds. The same applies to expenses incurred.

Gifts/Money credited to your account: If you have funds credited to your account out of Gifts or loan from relatives/ friends, you will need to keep the documentary evidence for the same. You may also need to report these transactions in few instances.

Declaring “Exempt” Income: Even though few incomes are exempt from income tax, you will need to declare this while filing your return.

Updating PAN details: Make sure to update any changes in your PAN data like address/surname change post marriage etc.

Pay Advanced Tax: If you are liable to pay advance tax, then you have to pay it as per schedules & deadlines.

Form 15H or 15G: If your income is below the taxable limit, use 15H/15G instead of claiming refund, submit this at all the financial institutions like banks to prevent them from deducting TDS on your investments with them.

Avoid High Value transactions: The IT department gets information of all your high value transactions from the concerned institutions and chances of you coming under scrutiny increases. Avoid these transactions wherever possible & plan it carefully and legally.

The above steps are considered good financial habits for people who want to avoid receiving Income Tax notices. Do you follow other practises to ensure that your IT is in place, every year? Share your views and questions with us on our Facebook and Twitter pages, or email at jaagorein@gmail.com

To know about the circumstances under which you can receive an Income Tax notice, read this first part of this three part series here.

More about the Experts:

Share this story on

What should you do if you receive an Income Tax Notice?

A notice from the Income Tax department can be stressful, especially because many of us do not understand what it entails or what needs to be done in response. To get a clearer understanding of the situation, we spoke to financial experts CA Rishabh Parakh, and he outlined a few steps that we can take in case of receipt of a notice from the Income Tax department.

1. Neither Panic nor Ignore

Your first reaction could be to press the panic button or ignoring it completely due to ignorance, both ways are wrong and key is to handle this carefully and sincerely else you may end up paying hefty penalty along with tax payment.

2. Check if it's issued in your PAN

Department issue notices based on your PAN and not by name, so make sure notice is issued in your PAN andis not meant for someone else who shares similar names or DOB as yours!

3. Identify the reason behind issuing a notice

Reasons could be a simple mismatch in TDS or inconsistency in your returns or some serious concerns like income concealment or survey or scrutiny of accounts.

4. Check Validity and Issuer Details

Check the validity of the notice, time of issuance, the IT section under which it has been issued, and also look at the mention of officer in-charge, his or her designation, signature, address with details of ward & circle no. etc. Verify these details in view to avoid being cheated.

5. Preparation two sets of documents and covering letter

Start collecting documents which you are asked to furnish before the assessing officer or things required based on the gravity of the notice and make sure you prepare a covering letter along with the set of documents. Prepare two set of all the documents required to be submitted to the department along with a covering letter, get a stamp on your copy for your record purpose and as a proof of submission of documents in compliance with the notice. You can also consult a CA for his help in drafting the proper income tax notice reply letter.

3 important points to remember

Reply on time – Always reply on time even if you are not able to collect the required documents. You can even ask for some time to prepare the same. It would establish that you are honest and cooperating with the laws.

Preserve the Envelope: If you receive the notice in an envelope please keep it safe as it contains Speed Post number which works as an evidence of its delivery to you.

Get Professional Help: If the gravity of the notice is high then it would be prudent to have a CA represent you. Otherwise, you can follow the above steps and represent yourself in most of the cases.

One of the major steps that you need to take even otherwise is to keep track & records of all your Tax papers & financial transactions for the last 8 years as it will help you substantiate your claims in case of any scrutiny.

There could be several reasons for receiving a notice from the Income Tax department, and it is important we know what to do when we get one. However, it is better if we follow good Income Tax practices to avoid getting a notice. If you have faced any issues with filing your IT returns or if you have any queries about notices from the Income Tax department, write to us at jaagorein@gmail.comor just comment on our Facebook and Twitter page.

More about the Experts:

Share this story on

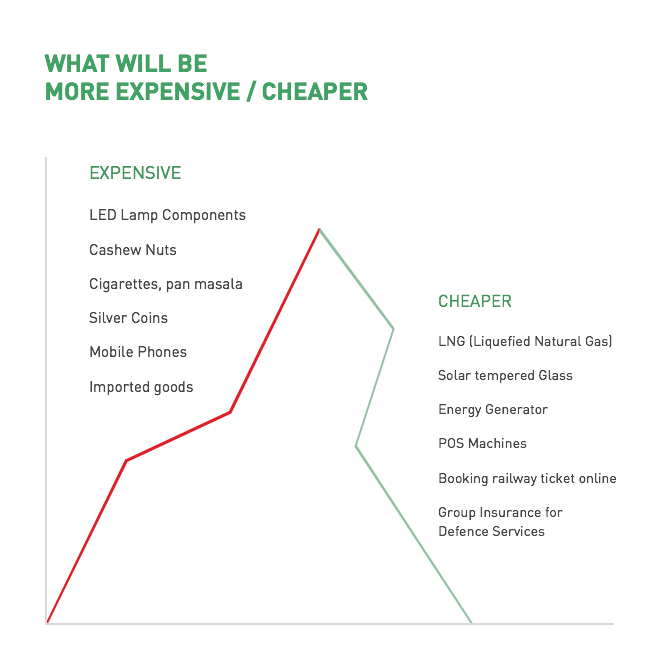

The Highlights of Budget 2017

The Budget presentation was preponed so as to allow enough time for the different departments of the government to access their allocations and put them to work as soon as the new fiscal year starts. The Finance Minister Arun Jaitley presented the Union Budget 2017 on 1st of February.

Here are a few highlights of Budget 2017.

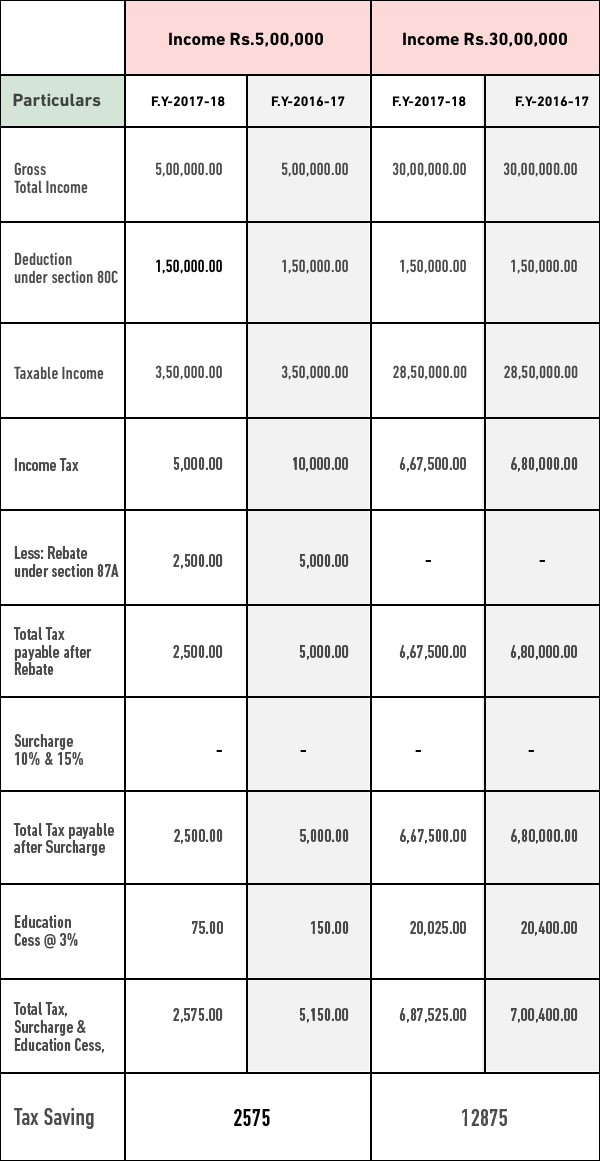

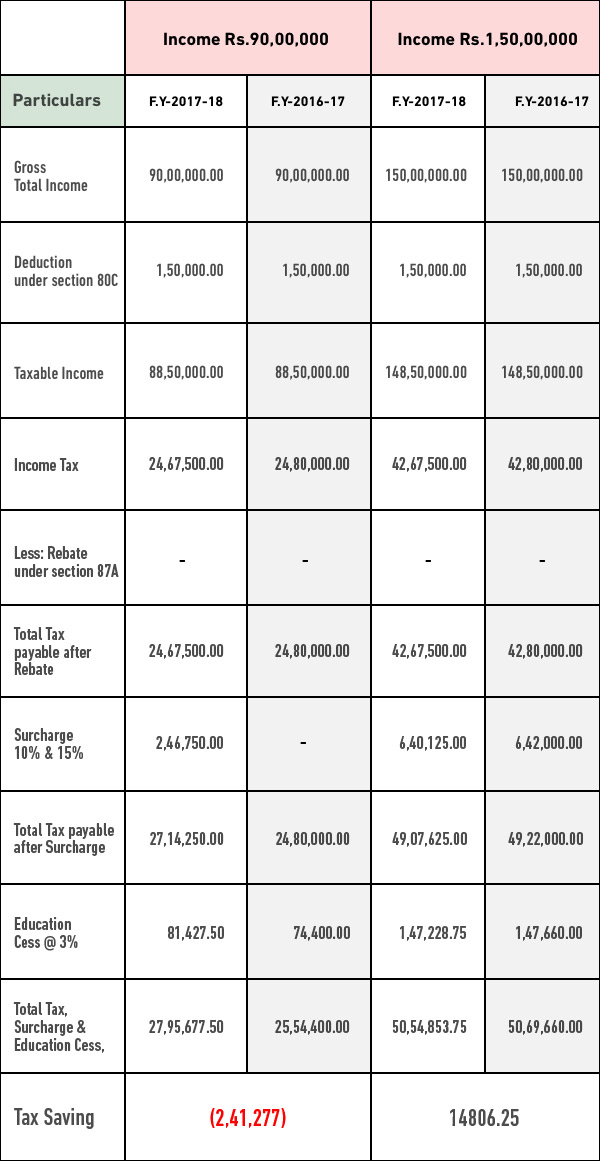

Personal Income Tax:

There is no change in the tax exemption limit under 80C but the government has reduced the tax rate to 5% for assessee whose income is between 2.5 lakhs to 5 lakhs and Zero tax liability for those earning up to rs. 3 lakh.

A taxpayer with taxable income of Rs. 5L will save a tax of Rs. 2575/-

A taxpayer with taxable income of Rs. 30L will save a tax of Rs. 12,875/-

A taxpayer with taxable income of Rs. 90L will pay extra tax of Rs. 2,41,277/-

A taxpayer with taxable income of Rs. 1.5Cr will save a tax of Rs. 14,806/-

Let us see the changes in your income tax slabs based on the table (different income levels) and on the assumption that you have already exhausted your 80C limit.

Introduction of Surcharge: A surcharge of 10% will be levied on individual incomes above Rs 50 lakh and upto Rs 1 crore, and this will inflate the tax outgo for people falling under this income range, as seen in the table.

No Scrutiny for first time filers: No scrutiny will happen for the Assessee who will be filing return for the first time.

Change in Holding Period for Capital Gains on immovable properties: The period for eligibility of qualifying as a long-term capital gain on immovable property is reduced to 2 years (from 3 years) and the base year indexation is also shifted from 1.4.1981 to 1.4.2001.

Simplified ITR form: A new 1 page ITR form will be introduced for the taxpayers whose income is up to 5 lakhs but this does not apply for the person deriving income from business.

ITR Revision: Now revising your Income tax return will not be easy as the time period is reduced to 12 months from the completion of a financial year, the current time period is a two years’ window.

Limit on Cash transaction: Now cash transaction above Rs. 3 lac will not be allowed and this decision is based on the recommendation by the Special Investigation Team (SIT) on black money which was set up by the Supreme Court.

Extension of Tax Break for Start-ups: Profit-linked deductions which is available to the startups is increased to seven years from the existing five years.

Cap on NPS withdrawal: Now going forward, partial withdrawals from your NPS cannot exceed 25% of the contribution, as per the PFRDA (Pension fund regulatory and development authority) Act 2013. This will become effective from 1st April 2018.

TDS on Rent above Rs. 50,000/-: People staying on rent and paying a rent of more than Rs 50,000 per month will have to start deducting a TDS of 5%. This is to bring in line the recipients of large rental income so that they come forward and declare their full rental income in their tax return, this will effective from 01-06-2017.

These are just a few pointers from the Budget presented by the Finance Minister. For more details, visit the Union Budget website of the government of India, and share your views on the Budget on our Facebook and Twitter pages, or email us at jaagorein@gmail.com.

Disclaimer:

The views expressed here belong to the expert alone, and do not necessarily represent that of the brand.

About the Author:

Share this story on

Rooting For Roona

What are you doing to ensure every child in born in his country has a fair shot at life? What would you do if you came across the story of Roona?

A documentary film maker and her crew form Bangalore have done something and that something is truly incredible and proof of how much can come out of one ordinary citizen wanting to cause change. Also, this is just the beginning of all that they plan to do. Pavitra Chalam and her team at Curly Street Media came across the story of baby Roona who was born in a tiny village in the state of Tripura with a birth defect known as hydrocephalus. Hydrocephalus causes a build up of fluid in the brain which leads to progressive enlargement of the head, mental disability, convulsions and could possibly end in death.

The picture of the almost alien like baby and the story of the plight of her laborer parents who live a hand to mouth existence, stirred something in the team and they began their campaign ‘Rooting For Roona.’ Roona’s story had gotten the attention of the press and a Norwegian crowdfunding was in full swing for her treatment. Pavitra and her team, during their research on Roona’s condition found out that it was not entirely uncommon, this set them on a new path, to bring attention to the flaws in India’s healthcare system and Roona would be their champion.

The Curly Street Media team met with Roona and her parents as she underwent the first round of surgery in a private hospital in Delhi. They have hours of footage of Roona, her parents, the doctors and NGO’s and activists who are working towards healthcare for babies born with congenital diseases in India. Rooting For Roona will be a documentary that will help shape public opinion about healthcare and help push for much needed reforms in the child health space. Recognising that they could not do this alone, the team launched a crowdfunding initiative to meet the production costs that making the film will require.

The campaign goes live in July and Pavitra leveraged the connected world we live in and appealed to friends and well wishers who in turn spread the message across social media channels. Almost two months after The Rooting for Roona Indiegogo crowdfunding campaign ended and has raised USD 32,001. It is officially the largest non-fiction film to be crowdfunded from India.

As baby Roona goes in and out of multiple surgeries and Pavitra begins pulling her documentary together we need to all take a moment and ask ourselves what we can do to make a difference. It need not be monumental or news worthy, but some action to help our fellow citizens must happen, it could be in the form of something as easy to do as vote.

Share this story on

Reclaiming The Streets and Not Asking For It

There is a common notion entrenched in the narrow minds of most Indians that women who get sexually harassed or assaulted were ‘asking for it’ because they were probably wearing provocative clothing. To see if this was anywhere near accurate an experiment was conducted, entries of the article worn or a picture of the article of clothing worn when an incident of sexual harassment took place were solicited from women across the country. The results are not what the narrow minds would expect, short skirts and halter tops do not rank at the top of the list, in fact the top three slots are taken by school uniforms, salwars and jeans.

This experiment was conducted by what started out as a student project at the Srishti School of Art Design and Technology in Bangalore in 2003. Led by Jasmeen Patheja, Blank Noise has now grown and matured into one the largest and most successful public initiatives that confront the issue of eve teasing in India.

Entirely run by volunteers or ‘Action Heroes’, Blank Noise seeks to intervene and speak up about acts of sexual harassment on the street and in public spaces by addressing and confronting the public. They have taken to the streets of cities to ‘reclaim’ them by not being ‘idle’. They have spray painted walls and converted a street that was perceived as unsafe into a safe zone by setting up tables and chairs over which the volunteers had a conversation with total strangers of the opposite sex. They have conducted a night walk across key cities, where women took to the street and turned the tables on eve teasers by confronting them and not pretending like it was an acceptable circumstance. They have done all this because they want change.

The Action Heroes of Blank Noise really are heroes. They do this for no compensation or recognition, but simply because they want to make a difference. Jasmeen is working off of the faith that there are enough people out there who are willing to take on the issue of eve teasing and she has rallied them. Such is the power of faith, perseverance and unwavering will. Such is the power of one woman and the influence she can have. Such is the power of when people come together for a single unanimous cause.

http://blog.blanknoise.org/

http://actionheroes.blanknoise.org/

Share this story on

49 की शक्ति - सही उम्मीदवार के पीछे

.png)

पिछले आम चुनाव जो वर्ष 2009 में हुए, एक अनुमान के अनुसार चुनाव में खड़े 150 सांसदों के खिलाफ आपराधिक आरोप थे। 14 वीं लोकसभा के चुनावों (2004 में) में आपराधिक रिकॉर्ड वाले 128 उम्मीदवार थे, उनके मुकाबले इस बार आपराधिक रिकॉर्ड वाले सांसदों में 17.2% वृद्धि हुई। 2004 के चुनावों से 2009 में गंभीर अपराधों के आरोप वाले सांसदों की संख्या में 30.9% की वृद्धि भी हुई थी।

यदि आप गणित की बात करते हैं, तो इसका मतलब हुआ कि 15 वीं लोकसभा के चुनाव में हर चार कानून निर्माताओं में से एक ऐसे को चुना गया जिसने खुद कानून तोड़ा है।

लोकसभा में दागी सांसदों की अधिकतम संख्या भेजने का उत्तर प्रदेश ने रिकॉर्ड बनाया। उनके 80 सांसदों में से 31 के खिलाफ आपराधिक मामले लंबित थे। उन 31 में से 22 पर गंभीर अपराधों के, दस पर जघन्य अपराधों के आरोप थे। महाराष्ट्र दूसरे स्थान पर रहा, जिसके 23 सांसदों के खिलाफ आपराधिक मामले हैं, उनमें से नौ पर गंभीर अपराधिक मामले हैं।

इन ढेर सारे आरोपों में से बलात्कार और महिलाओं के खिलाफ अपराधों से जुड़े हैं। कुछ सांसद जो इस समय सत्ता में हैं, उनके आरोप पत्र में अपहरण, हमले और इनमें सबसे जघन्य मामलों में हत्या के आरोप भी हैं। ये वे लोग हैं जो कानून और नीतियां बना रहे हैं जिनके हिसाब से हमें रहना और जिनका पालन करना होगा। सही में यह विडंबना ही है?

तो भीइसकी कोई जवाबदेही नहीं डाल रहा, हम ही हैं जिन्होंने अपने वोट के द्वारा इन्हें सत्ता में लाएं हैं मतदान नहीं किया तो यह और भी बदतर है क्योंकि इसका मतलब हुआ कि आप शांत बैठे रहे और ऐसे नेताओं को लोकसभा में बैठने दिया।

2014 में दुनिया के सबसे बड़े लोकतंत्र के 16वें आम चुनाव होंगे और कौन इसे चलाएगा यह शक्ति हमारे हाथ में है। सही उम्मीदवार को हर एक वोट मायने रखता है और यही समय है बड़े मतदाता समूह को एकजुट करने का, जिसे नजरअंदाज कर दिया गया है। भारत में सभी पंजीकृत मतदाताओं में 49% महिलाएं हैं। अभी शुरू करें, हमारी मां, बहनों, पत्नियों, बेटियों, चाची-बुआ, महिला मित्रों, सहयोगियों एवं हमारे परिवारों और सामाजिक दायरे के भीतर प्रत्येक अन्य महिला को सही उम्मीदवार का चयन करने और वोट के लिए घर से निकलने के लिए शिक्षित करना हममें से हर एक की व्यक्तिगत जिम्मेदारी है।

Share this story on