Declaring and submitting proofs for Investments

The end of financial year is approaching, and employed people must have received communication from their employers to submit their investment proofs for the year 2015-16. Let us understand this process and how you can save taxes with the help of investment declaration to your employer: -

What is Investment Declaration?

All employers deduct income tax from your salary on a monthly basis which goes to the government. The government allows tax saving on certain investments, like Life insurance premium/tuition fees/Home Loan Principal, NSCs, PF, PPF, Mutual Funds ELSS, Tax Savings FDs etcetera. Apart from that you are also entitled to claim benefit for LTA, HRA, interest on your home loans and Reimbursements of Medical expenses etcetera. These investments are not taxed by the government. Then, to know how much of your salary is taxable, the employer asks you to declare your investments.

How does it work?

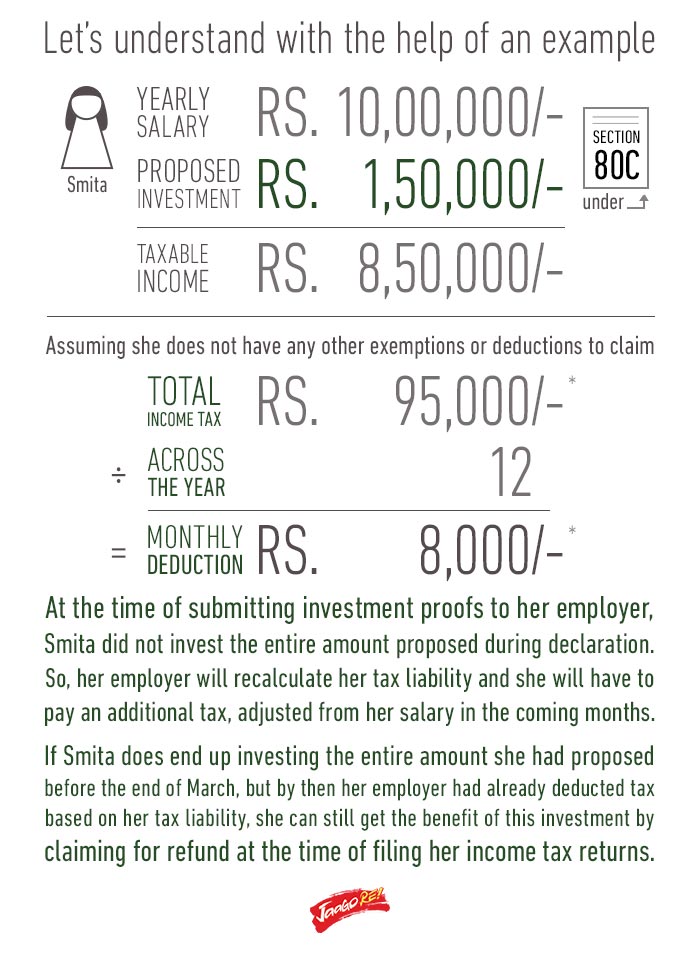

At the start of every financial year, your employer asks you to submit a "declaration" of your proposed (existing) investments/options as mentioned above, so that your net taxable salary can be calculated and there by tax will be deducted and you get the net in hand every month.

Do you need to submit any proofs at the time of Declaration?

You are not required to submit proofs at the time of declaration. All you need to do is to plan your tax savings in advance in terms of how much is your obligatory/ongoing existing investments like PF, insurance premiums, tuition fees etcetera.

You can go ahead and submit a declaration that you "WILL" be investing in all the above mentioned items, this activity does not require you to submit actual proofs because it is just the start of the financial year, you only need to "Declare" that you will be investing in various 80C options, paying off rent to claim HRAs or claiming interest on your home loans.

What is the 'final Submission of actual proofs'?

During the months starting from December to January your employer will ask you to provide actual proofs for the investment declarations you had made earlier, so that they can verify and finalise your tax computation. So you need to submit all the copies/receipts/statements/proofs as against your declaration.

Do you need to invest in the same options as per your declaration?

Your investments need not be exactly the same as per your declaration. For example in your declaration, you might have mentioned that you will be investing in PPF or life insurance, but rather at the end you might have invested in a mutual funds ELSS or your home loan principal amount itself is more than Rs. 1,50,000/-. In that case, if you provide actual proofs of these investments which are different from your declaration, you will be eligible to claim the tax benefits and your employer will take these into account to calculate & finalise your tax liability.

What if you could not submit investment proofs?

If you could not submit investments proofs in time either because you have actually not invested the money as required or even though you had invested, you could not upload or submit the proofs to your employer, your employer will recalculate tax liability and will adjust the additional tax in the remaining months of January or February to March.

Do you lose the benefit in case you didn't submit the proofs to employer?

This is one of a biggest myth that if you don't submit proofs to your employer then you lose all the tax benefits; No, you don't. You can still claim the benefits of your investments by filing your tax returns and claiming a refund. But you should always make sure that you submit this in time to avoid going through claiming it via refund, which unnecessarily delays the entire process.

It is always better to plan your taxes in advance and invest on time, so that you can save more and avoid the hassle of claiming refund at a later stage.

Do you think this article is helpful? Would you like to know more about filing investment proofs? Write to us on our Facebook and Twitter pages, or email us at jaagorein@gmail.com.

More about the Expert:

Share this story on